Businesses should apply logic that makes sense for their particular situation, but make sure to follow the rules outlined by the U.S.

The cost of goods should be clearly defined in order to remain consistent while reporting on crucial metrics like gross profit, though, there are no generally accepted accounting principles (GAAP) on the type of costs that are included. But the cost associated with cross-selling or upselling a different product or service to an existing customer would be excluded.

Cost of revenue vs cogs software#

Equipment related to providing professional servicesįor instance, the COGs of a software company would include the hosting costs required to deliver web services to customers, users, or subscribers. Since there are 1500 pounds of potatoes left, the assumption is that 1000 pounds were purchased in week 4, and 500 pounds.But the cost to send the phones to carrier locations and labor used to sell the phone would be excluded.

Cost of revenue vs cogs plus#

Depending on the type of business, these costs can include:Ī good cost of goods sold example is that of a smartphone manufacturer, who would include the material costs for the parts that go into making the phone plus the labor-associated costs to put the phone together. An important metric on financial statements, when subtracted from gross profit, COGS helps measure a business’ profitability and evaluate efficiency.

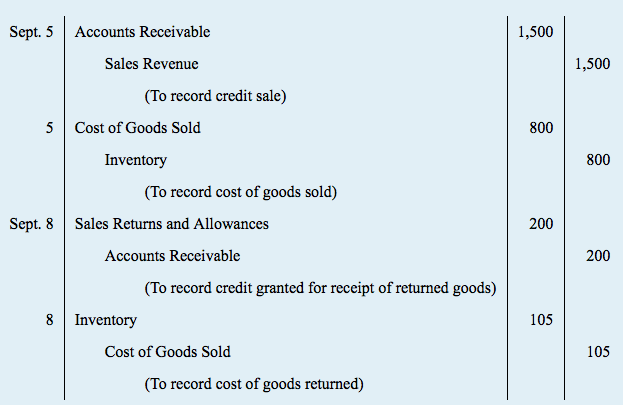

It does not store any personal data.Cost of goods sold or COGS is the accumulated total of all business costs used to create any products or services which have been sold. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. The cookie is used to store the user consent for the cookies in the category "Performance". It excludes indirect expenses, such as distribution costs and sales force costs. This amount includes the cost of the materials and labour directly used to create the goods. This cookie is set by GDPR Cookie Consent plugin. Cost of goods sold (COGS) Cost of goods sold (COGS) or cost of sales refers to the direct costs of producing the goods sold by a company. The cookies is used to store the user consent for the cookies in the category "Necessary". This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. This cookie is set by GDPR Cookie Consent plugin. Cost of Goods Sold When making investments, businesses need to analyze their expense and income reports, particularly the cost of sales (CoS) and the cost of goods sold (CoGS).

The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". The cookie is used to store the user consent for the cookies in the category "Analytics". These cookies ensure basic functionalities and security features of the website, anonymously. Necessary cookies are absolutely essential for the website to function properly. Most service businesses do not have direct expenses at all, which is another reason to have these costs broken up. This can give a business an idea of how much profits they would stand to make after accounting for all other expenses.īusinesses also use gross profit margins to compare themselves to competitors in the industry to see where they stand. In most cases revenue and cost of goods sold increase proportionately as a business would produce more as they sell more, but things like economies of scale may cause COGS to be less.Ĭalculating direct costs separately also allows Gross Profit margin to be calculated which is a metric that shows how much of revenue is remaining after accounting for direct expenses. Why break it into direct and indirect costs?īy subtracting the direct costs, which is COGS, which is associated directly with the production of a product or service from revenue, a business is able to know exactly how much goes into what they are selling. Cost of goods sold (COGS) or cost of sales refers to the direct costs of producing the goods sold by a company.

0 kommentar(er)

0 kommentar(er)